ACCURAY (ARAY)·Q2 2026 Earnings Summary

Accuray Cuts Full-Year Guidance as Restructuring Takes Hold

February 4, 2026 · by Fintool AI Agent

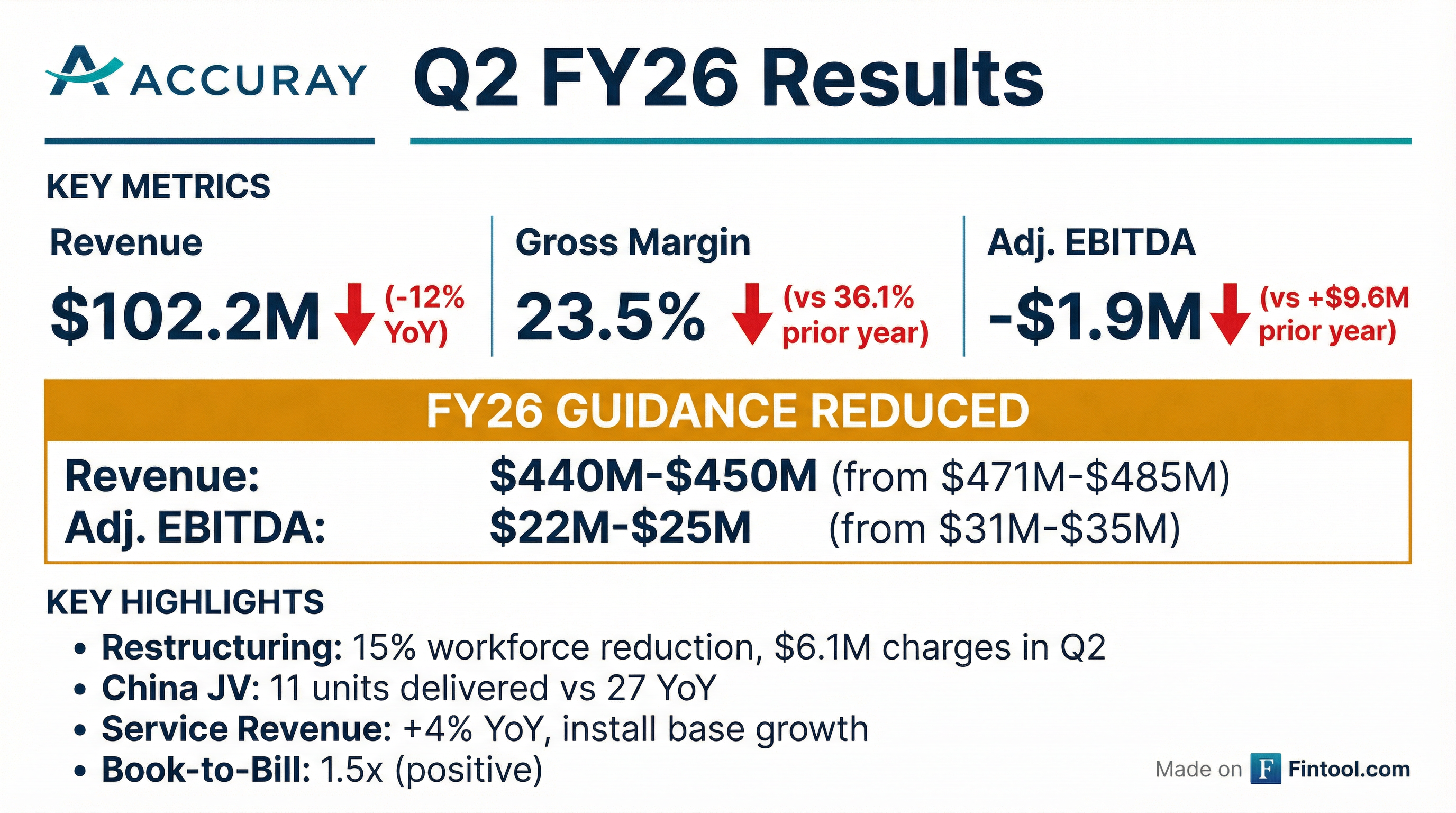

Accuray (NASDAQ: ARAY) reported Q2 FY26 results that modestly beat revenue expectations but delivered a significant guidance cut that overshadows the quarterly beat. Revenue of $102.2M exceeded the $100.9M consensus by 1.3%, while EPS of ($0.11) matched expectations . The stock closed at $0.76, relatively flat on the day.

The main event: management slashed FY26 revenue guidance by ~$25M (6-8%) and EBITDA guidance by ~$8M (26-29%), while announcing a sweeping restructuring that includes a 15% workforce reduction .

Did Accuray Beat Earnings?

Accuray delivered a modest beat on the top line but the details reveal a challenging quarter:

The year-over-year comparisons tell a tougher story:

The 26% decline in product revenue was driven primarily by the China joint venture delivering only 11 systems versus 27 in the prior year period . Service revenue continued to grow as the install base expands.

What Did Management Guide?

This is where the quarter gets ugly. Management slashed full-year guidance materially:

At the midpoint, this represents a $24M revenue cut and $9.5M EBITDA cut from prior expectations. The revised revenue guidance implies roughly flat to down 2% for the full year versus prior expectations of +3% to +6% growth.

What Changed From Last Quarter?

Several key developments since Q1:

1. New CEO Announces Transformation Plan — On December 15, 2025, CEO Steve La Neve announced a comprehensive restructuring targeting $25M in annualized operating profit improvement :

- 15% global workforce reduction

- Organizational realignment and commercial simplification

- Outsourcing of non-core activities

- ~$12M in savings expected in FY26

2. Restructuring Charges Hit Results — Q2 included $6.1M in restructuring charges ($4.1M severance, $0.7M implementation costs, $1.2M impairments). Total FY26 restructuring charges expected to reach $13M .

3. China JV Remains Headwind — The joint venture shipped only 11 units to end customers versus 27 in Q2 FY25, creating a significant margin drag. Net margin release of $1.2M in Q2 partially offset prior deferrals .

4. Working Capital Improved — Days Sales Outstanding dropped to 43 days, down 27 days year-over-year, reflecting improved cash collection .

Key Management Quotes

CEO Steve La Neve emphasized execution discipline despite the challenges:

"Over the past 90 days, I've met extensively with Accuray teams and customers across all major regions. Their insights have directly informed the decisive actions we've already taken — from reorganizing our commercial structure to refining our near‑term product and service investment priorities."

"While this transformation is in its early stages, the pace of execution, the alignment across the organization, and the level of accountability give me confidence that we are on the right trajectory. Our objectives remain clear: accelerate top‑line growth, enhance our competitive position, expand profitability, and deliver sustainable long‑term value."

How Did the Stock React?

ARAY shares have been under significant pressure over the past year, trading near 52-week lows:

The stock has declined approximately 74% from its 52-week high as investors digest the ongoing China headwinds and now the significant guidance cut. The muted reaction on earnings day may reflect that much of the bad news was telegraphed with the December restructuring announcement.

Margin Drivers: What Went Wrong?

The 23.5% gross margin (vs 36.1% prior year) was driven by three primary factors, per CFO Ali Pervaiz:

Management expects product gross margins to stabilize between 20%-30% going forward, "highly dependent upon product mix shipped out and also dependent upon the timing of releases, which is very China-centric" .

Segment Performance

Product Revenue ($45.0M, -26% YoY) — The dramatic decline reflects fewer system deliveries, particularly from the China JV. Gross product orders of $66.1M were down from $76.8M in Q2 FY25, though the book-to-bill ratio of 1.5x (vs 1.3x prior year) suggests improving order momentum .

Service Revenue ($57.2M, +4% YoY) — Recurring service revenue continues to grow driven by install base expansion and favorable pricing. Service now represents 56% of total revenue versus 47% in the prior year quarter .

Balance Sheet and Liquidity

Cash declined $16M in the first half as the company works through restructuring and elevated interest expenses ($15.2M YTD vs $5.3M prior year) .

Q&A Highlights

On the 40/60 Revenue Split (Marie Thibault, BTIG): Analyst asked why guidance was cut given first-half revenue was "right on track" for the typical 40/60 split. CEO La Neve corrected that historical seasonality is closer to 45/55, and explained that China's "quota, license, tender, then funding" process has slowed, making deal dynamics "more protracted" than anticipated .

On Hospital CapEx Environment (Young Lee, Jefferies): Asked whether hospitals are pulling back on capital spending. La Neve said they "don't see CapEx shifts by hospitals downward" and see "opportunities for our equipment to be purchased or leased" across geographies. No shift or trend working against equipment purchases .

On Customer Priorities: Across geographies, health systems are prioritizing three things: reliability, interoperability, and patient throughput. This clarity is helping sequence the product roadmap and service investments .

Transformation Initiatives in Motion

Beyond the 15% workforce reduction, management outlined several strategic initiatives already underway:

-

Service Portfolio Expansion — Building tiered offerings (Select, Advantage, Optimum programs) that go beyond break-fix to include training, quality support, data management, real-time monitoring, software upgrades, and consulting

-

Distributor Pay-for-Performance — New tiered channel partnership model where higher-performing distributors enjoy better transfer pricing. Adding dedicated channel leadership

-

Revenue Leakage Fix — Designing systems to ensure compensation for services provided: "We are now designing and implementing systems, processes, and controls to help ensure we are compensated to the extent to which we are entitled"

-

Pricing Optimization — Ensuring pricing reflects clinical and economic value, facilitating competitive bids at appropriate margins

-

CCO Search — Expect to announce a new global Chief Commercial Officer appointment "in the period ahead"

EBITDA Margin Timeline: Management "continues to expect to reach a high single-digit adjusted EBITDA margin run rate within the next nine months and to expand that margin to double digits over the medium to long term" .

What to Watch Going Forward

-

Restructuring Execution — Can management deliver the $25M in annualized savings and hit the $12M FY26 target?

-

China JV Recovery — The JV has $17.4M in deferred margin on the balance sheet waiting to be released as systems are delivered to end customers .

-

Book-to-Bill Momentum — The 1.5x book-to-bill is encouraging, but backlog has declined 17% YoY. Watch for order recovery.

-

Cash Runway — With $42M in cash, elevated interest expense, and ongoing restructuring costs, liquidity bears monitoring.

-

CCO Hire — Quality of the incoming Chief Commercial Officer will signal whether management can upgrade commercial execution.

Disclosure: This analysis was generated by Fintool AI Agent based on company filings and public data. It does not constitute investment advice.